Guest Article – HMRC

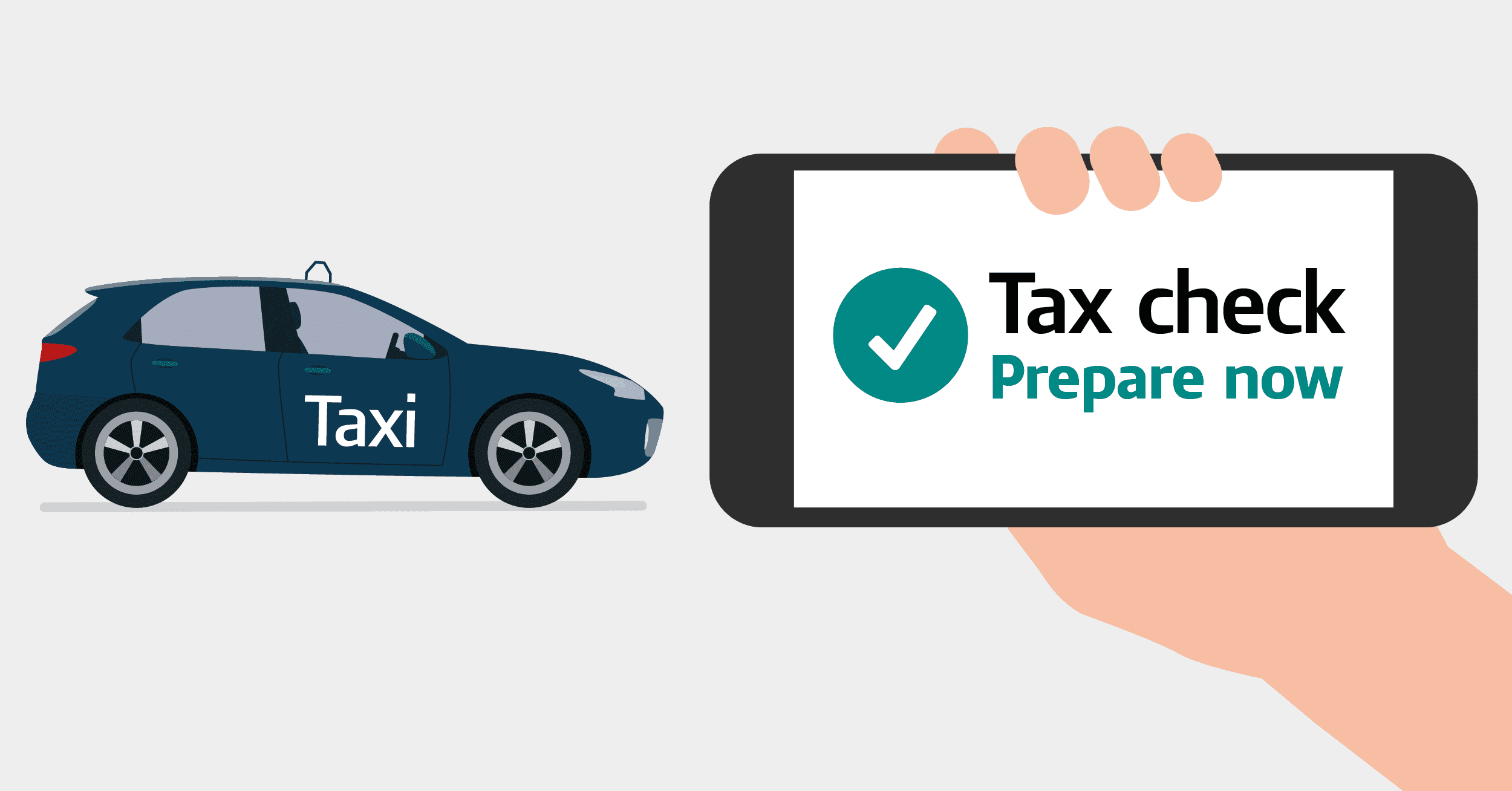

The government is putting in place new tax requirements for applications to certain licences. This is supported by a new digital service, being developed by HMRC. It helps people in the taxi, private hire and scrap metal industries to complete a new tax check.

Most people are registered to pay tax and this is about ensuring everyone pays the tax they should, creating a level playing field for the compliant majority. HMRC are working with industry bodies to make this as straightforward as possible. The check should take a few minutes every few years and is simply to confirm that someone is appropriately registered for tax.

You’ll need to complete a tax check when you renew your licence as a:

- driver of a taxi (hackney carriage)

- driver of a private hire vehicle (and dual licences)

- private hire vehicle operator

- scrap metal dealer mobile collector

- scrap metal dealer site

About the tax check

You will be able to complete this tax check on GOV.UK, through your Government Gateway account. You will only need to answer a few questions to tell HMRC how you pay any tax that may be due on income you earn from your licensed trade. If you do not already have a Government Gateway account, you can sign up on GOV.UK.

The tax check should only take a few minutes. There’ll be guidance on GOV.UK and anyone who needs extra support will be able to complete the tax check by phone through HMRC’s customer helpline.

When you’ve completed the tax check, you’ll get a code. You must give this code to your licensing body. The licensing body cannot proceed with your licence application or renewal until the tax check is completed and they’ve received the code.

Your licensing body will only receive confirmation from HMRC that you’ve completed the tax check, they will not have access to information about your tax affairs.

Registering for tax

You may have to pay tax through Pay as You Earn (PAYE), Self Assessment and/or Corporation Tax, depending on your circumstances. If you should have been registered to pay tax and have not been, HMRC will work with you promptly and professionally to get you back on the right track. It’s your responsibility to get your tax right, but HMRC are here to help.

If you’re an employee: Pay As You Earn (PAYE)

Most employed people pay Income Tax through PAYE. This is the system employers use to take Income Tax and National Insurance contributions before they pay wages.

See more information on PAYE.

If you’re self-employed: Self Assessment tax returns

If you’re self-employed you’ll pay Income Tax and National Insurance through Self Assessment. You’ll need to fill in a tax return every year.

You must send a tax return if, in the last tax year (6 April to 5 April), you were:

- self-employed as a ‘sole trader’ and your annual gross trading income was more than £1,000

- a partner in a business partnership

See more information on registering for Self Assessment.

If you operate through a company: Corporation Tax

Companies need to register for Corporation Tax when they start doing business or restart a dormant business.

See more information on Corporation Tax.