Guest Article – HMRC

HM Revenue and Customs (HMRC) is warning tax credits customers to be aware of scams and fraudsters who imitate the department in an attempt to steal their personal information or money.

About 2.1 million tax credits customers are expected to renew their annual claims by 31 July 2022 and could be more susceptible to the tactics used by criminals who mimic government messages to make them appear authentic.

Get news and info from your local council – sign-up for email bulletins.

In the 12 months, to April 2022, HMRC responded to nearly 277,000 referrals of suspicious contact received from the public. Fraudsters use phone calls, text messages and emails to try and dupe individuals – often trying to rush them to make decisions. HMRC will not ring anyone out of the blue threatening arrest – only criminals do that.

Typical scam examples include:

- phone calls threatening arrest if people don’t immediately pay fictitious tax owed. Sometimes they claim that the victim’s National Insurance number has been used fraudulently

- emails or texts offering spurious tax rebates, bogus COVID-19 grants or claiming that a direct debit payment has failed

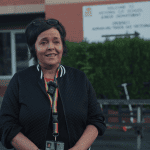

Myrtle Lloyd, HMRC’s Director General for Customer Services, said, “We’re urging all of our customers to be really careful if they are contacted out of the blue by someone asking for money or bank details.

“There are a lot of scams out there where fraudsters are calling, texting or emailing customers claiming to be from HMRC. If you have any doubts, we suggest you don’t reply directly, and contact us straight away. Search GOV.UK for our ‘scams checklist’ and to find out ‘how to report tax scams’.”

HMRC does not charge tax credits customers to renew their annual claims and is also urging them to be alert to misleading websites or adverts designed to make them pay for government services that should be free, often charging for a connection to HMRC phone helplines.

Customers can renew their tax credits for free via GOV.UK or the HMRC app and are advised to search GOV.UK to get the genuine information and guidance.

Renewing online is quick and easy. Customers can log into GOV.UK to check the progress of their renewal, be reassured it is being processed and know when they will hear back from HMRC. Customers choosing to use the HMRC app on their smartphone can:

- renew their tax credits

- update changes to their claim

- check their tax credits payments schedule, and

- find out how much they have earned for the year

HMRC has released a video to explain how tax credits customers can use the HMRC app to view, manage and update their details.

If there is a change in a customer’s circumstances that could affect their tax credits claims, they must report the changes to HMRC. Circumstances that could affect tax credits payments include changes to:

- living arrangements

- childcare

- working hours, or

- income (increase or decrease)

Tax credits are ending and will be replaced by Universal Credit by the end of 2024. Many customers who move from tax credits to Universal Credit could be financially better off and can use an independent benefits calculator to check. If customers choose to apply sooner, it is important to get independent advice beforehand as they will not be able to go back to tax credits or any other benefits that Universal Credit replaces.

[button color=”” size=”large” type=”square_outlined” target=”new” link=”https://public.govdelivery.com/accounts/UKWCBC/subscriber/new?topic_id=UKWCBC_5″]SIGN UP[/button]